KS TR-150 2007 free printable template

Show details

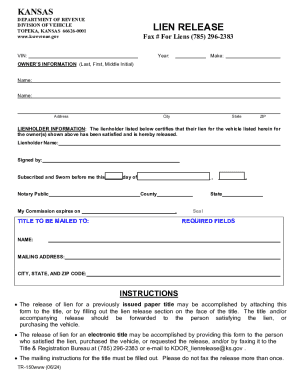

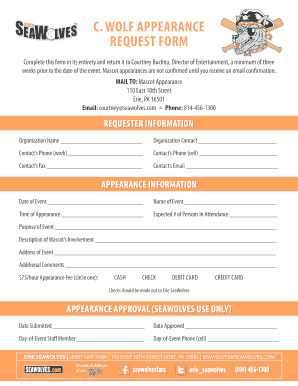

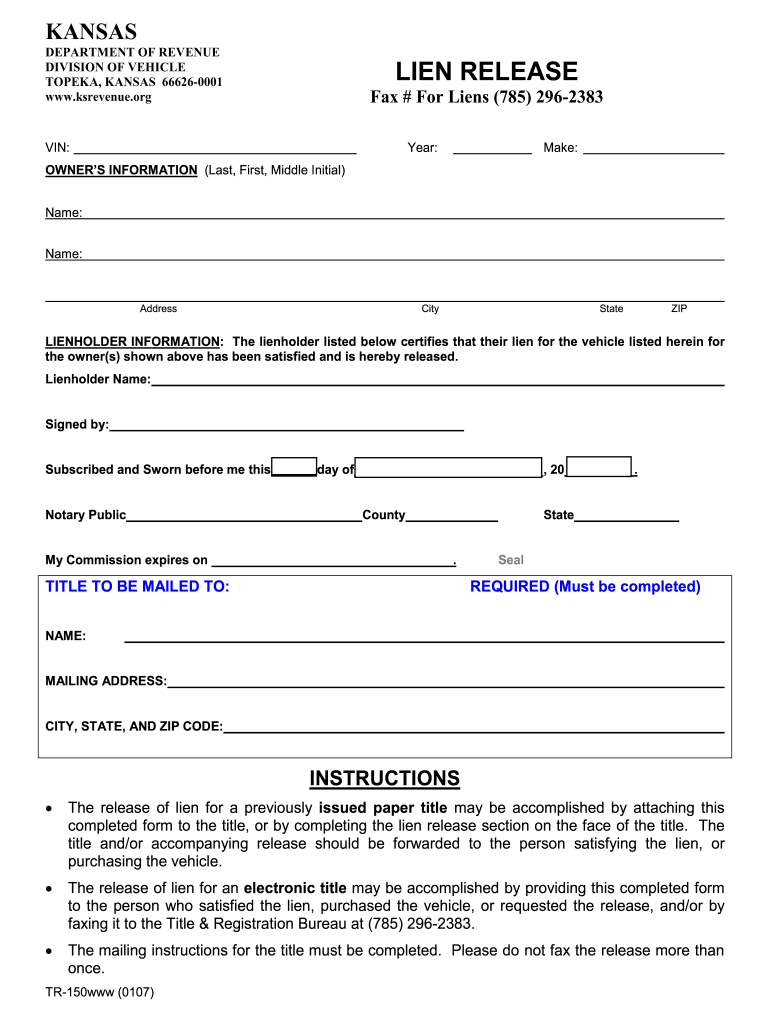

KANSAS DEPARTMENT OF REVENUE DIVISION OF VEHICLE TOPEKA KANSAS 66626-0001 www. ksrevenue. org LIEN RELEASE Fax For Liens 785 296-2383 VIN Year Make OWNER S INFORMATION Last First Middle Initial Name Address City State ZIP LIENHOLDER INFORMATION The lienholder listed below certifies that their lien for the vehicle listed herein for the owner s shown above has been satisfied and is hereby released. Lienholder Name Signed by Subscribed and Sworn before me this Notary Public My Commission expires...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS TR-150

Edit your KS TR-150 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS TR-150 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS TR-150 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KS TR-150. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS TR-150 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS TR-150

How to fill out KS TR-150

01

Gather all necessary information pertaining to your tax situation.

02

Download the KS TR-150 form from the Kansas Department of Revenue website.

03

Fill out your personal information, including name, address, and Social Security number.

04

Provide details of your income sources as requested on the form.

05

Calculate your deductions and credits based on the guidelines provided.

06

Double-check all calculations for accuracy before submitting.

07

Submit the form to the appropriate Kansas Department of Revenue office by the deadline.

Who needs KS TR-150?

01

Individuals and businesses in Kansas who are required to report income or tax liability.

02

Taxpayers seeking to claim deductions or credits specific to Kansas tax law.

03

Any person or entity that has experienced a change in their financial situation during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I release a lien in Kansas?

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

How long does it take to get a title after a lien release in Kansas?

Do I get my title back, if so when? Your Kansas title will be mailed to you if there is not a lien against the vehicle. Please allow 4 to 6 weeks for delivery. If there is a lien, the title will not be printed until the lien is paid off and a lien release has been submitted with the State of Kansas.

How do I release a lien on a Kansas title?

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

How do I get a lien removed in Kansas?

If you would like to remove the lien holder's name from the title, you must fill out an application for a reissue title (TR-720B) and bring it, along with your current vehicle registration, title and lien release to any one of the tag offices. The cost is $10.00.

Is KS a title holding state?

Kansas is a “lien holding” state. This means that the Kansas Department of Revenue holds the title on any vehicle that is bound by a lien. The lien is not available to the owner until payment is made in full on the purchase price or other loan in which the vehicle is a collateral.

How do I get a copy of my electronic title in Kansas?

You will need to complete the Application for Secured/Duplicate/Reissue Title, form TR-720B that includes the following information: vehicle year, make and identification number, owner's name(s) and the current odometer reading. Include appropriate title fee. The title fee in Kansas is $10.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KS TR-150 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like KS TR-150, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute KS TR-150 online?

Easy online KS TR-150 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the KS TR-150 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your KS TR-150 in seconds.

What is KS TR-150?

KS TR-150 is a form used for reporting certain financial information to the state of Kansas, typically related to tax obligations.

Who is required to file KS TR-150?

Entities such as businesses and individuals who are subject to specific tax requirements in Kansas are required to file KS TR-150.

How to fill out KS TR-150?

To fill out KS TR-150, you need to provide required financial details, follow the instructions included with the form, and submit it along with any necessary attachments.

What is the purpose of KS TR-150?

The purpose of KS TR-150 is to provide the state with necessary financial information to assess tax liabilities and ensure compliance with state tax laws.

What information must be reported on KS TR-150?

KS TR-150 requires reporting of various financial details, including income, deductions, and relevant tax calculations specific to the filer’s situation.

Fill out your KS TR-150 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS TR-150 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.